In the world of stock trading 📊, understanding market trends is crucial for making smart investment decisions. Two major market trends dominate the financial world: Bull Markets ➕ and Bear Markets ➖. Let’s dive deep into their meanings, characteristics, and how you can profit from them.

✨ What is a Bull Market?

A Bull Market refers to a period when stock prices are rising ⬆️ and investor confidence is high. This trend often lasts for months or even years. It signals strong economic growth, low unemployment, and high consumer spending.

Key Features of a Bull Market:

- Stock prices increase ↑ steadily.

- Strong economy ✨ with rising GDP.

- High investor confidence 💪🏼.

- Lower unemployment rates 🏢.

- More people buying stocks 📈.

How to Profit in a Bull Market?

- Buy and Hold Strategy — Invest in stocks early and hold them as prices rise.

- Growth Stocks — Focus on high-potential stocks that thrive in an expanding market.

- Index Funds & ETFs — Broader exposure to the overall market.

💡 What is a Bear Market?

A Bear Market is the opposite of a bull market. It occurs when stock prices decline ⬇️ by 20% or more over a sustained period. Investors become pessimistic, leading to lower demand for stocks.

Key Features of a Bear Market:

- Stock prices decline ↓ sharply.

- Weak economy ❌ with slowing GDP.

- High unemployment 🏃♂️ as companies cut jobs.

- Low investor confidence 😓.

- People sell stocks out of fear 🤯.

How to Profit in a Bear Market?

- Short Selling — Make money by betting on falling stocks.

- Defensive Stocks — Invest in stable industries like healthcare ⚕️ and utilities.

- Gold & Bonds — Safe-haven assets tend to perform well.

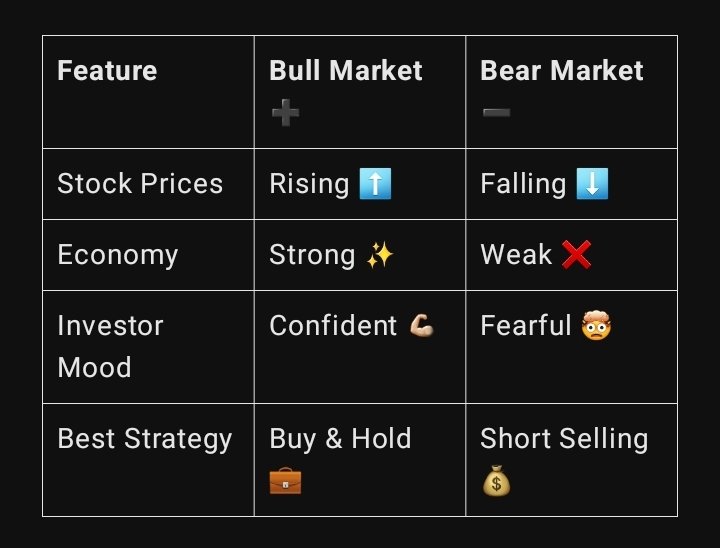

⌚ Bull vs. Bear Market: Quick Comparison

🌟 Final Thoughts

Both Bull ➕ and Bear ➖ markets are part of the stock market cycle. Understanding these trends helps investors make informed decisions. Whether the market is rising or falling, smart strategies can turn any trend into a profit opportunity 📈!